Umee is unlike these protocols," he told Decrypt. "Other protocols use bridges to create wrapped assets-essentially a quantity of a blockchain’s native currency equivalent to the non-native asset. Though users will technically be leveraging Gravity Bridge, a connector between Cosmos and EVM-compatible blockchains, for their DAI transfers, Xu claims Umee is much more than just a bridge protocol.

ĭAI is already integrated with over 20 different crypto networks, including Solana, Fantom, and Polygon, according to DeFi Llama. This dominance has also drawn criticism to DAI’s claim of being a “decentralized” stablecoin, given how centralized USDC is. A host of other cryptocurrencies are also eligible to be used as collateral, including Wrapped Bitcoin (WBTC), Uniswap (UNI), Polygon (MATIC), and others.Įach collateral asset carries its own “minimum collateral ratio,” too, which dictates how much of said asset you need to put up to mint DAI.ĭata dashboard DAI Stats indicates that the most popular collateral for minting Maker’s stablecoin is Circle’s USDC. In order to mint, for example, $1 of DAI, you need to deposit up to $1.75 in Ethereum. It’s still magnitudes smaller than market leader Tether (USDT), but it’s also built a whole lot differently. Unlike Terra’s UST, DAI is an overcollateralized stablecoin with a market capitalization of $6.9 billion.

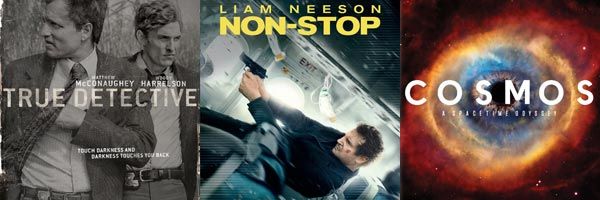

John and Jack's tale is the most fun, like a goofy episode of The. “Looking ahead, Umee’s broader mission includes creating cross-chain stablecoins and adding Cosmos assets to MakerDAO.” Last Stop has the feel of an anthology, telling three loosely linked stories that eventually intersect in the final chapter. “The UST collapse made it absolutely clear that the Cosmos ecosystem needs a robust, safe stablecoin,” Umee’s CEO Brent Xu told Decrypt.

0 kommentar(er)

0 kommentar(er)